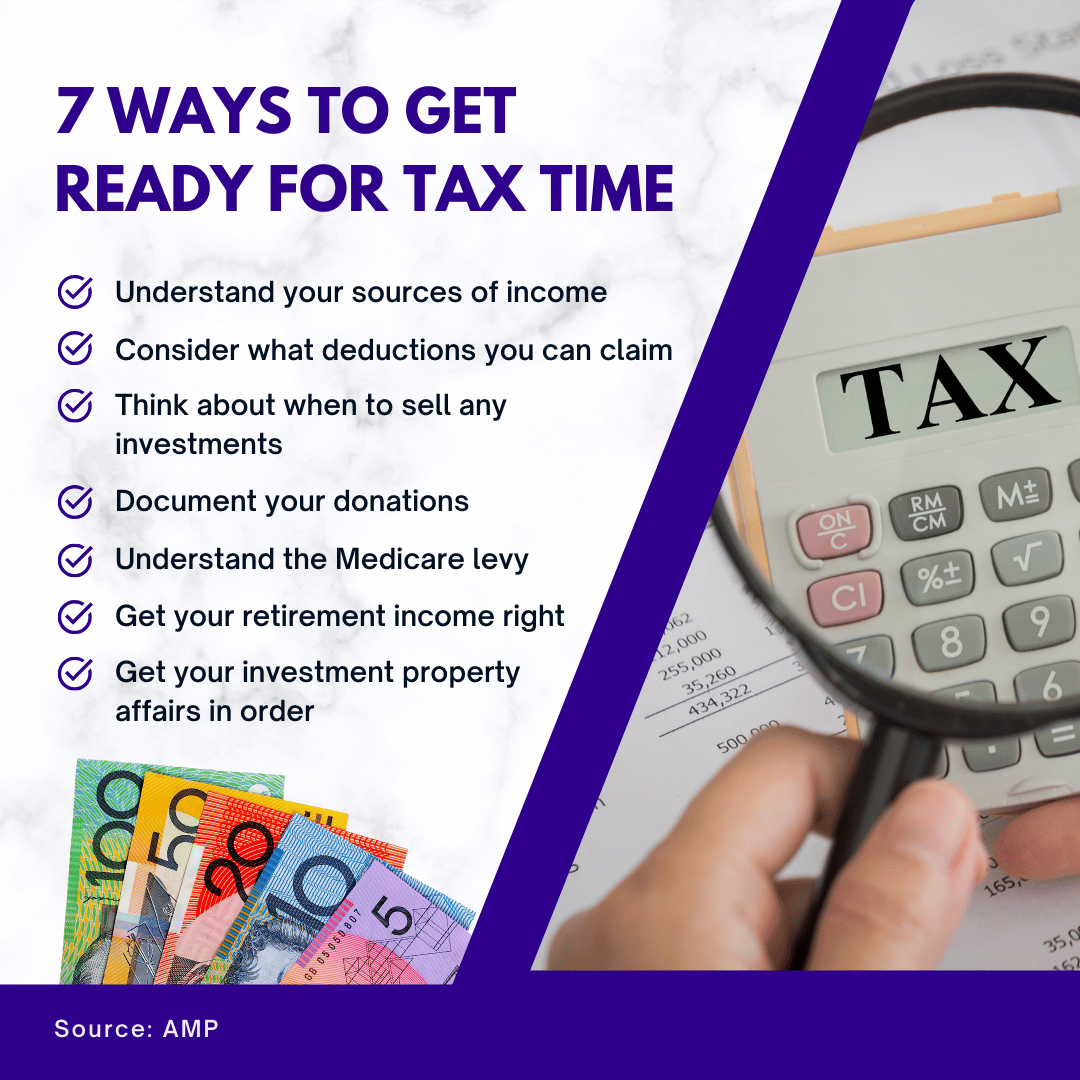

7 ways to get ready for tax time

Here’s a quick checklist to help you prepare for the end of financial year and maximise your tax time benefits. Understand your sources of income When it comes to tax, your wages are just the start. Income can come from all sorts of areas. Interest you’ve earned from bank accounts. Dividends you’ve received from shares. … Read more